Master Your Money Through Real-World Practice

Our household budgeting program runs for eight weeks and gets you working with actual expenses, real scenarios, and the messy decisions you'll face when managing a family budget.

Chat About Your Goals

We Skip Theory and Jump Straight Into Practice

Most budgeting courses throw spreadsheet formulas at you for six hours and call it done. That's not how we work. You'll spend week one setting up your tracking system using real bills from your kitchen counter. Week two? You're already making tough choices about groceries versus car repairs.

Our approach came from watching people struggle with generic advice that doesn't account for irregular income, surprise expenses, or partners who see money differently. So we built something that handles the chaos of actual household finances.

You'll work through scenarios that mirror what Australian families deal with—fluctuating utility bills, school costs that pop up mid-term, and those weeks when three birthday parties happen at once.

Your Numbers, Not Templates

Bring your actual expenses and income. We'll build your budget around what's really happening in your accounts, not some theoretical household.

Small Cohorts Only

Groups max out at twelve people so everyone gets attention. We've seen what happens in those 40-person webinars—nobody asks questions.

Fits Around Life

Sessions run Tuesday evenings or Saturday mornings. Miss one? The recordings stay accessible and we do quick catch-up calls.

How Eight Weeks Actually Breaks Down

Each week builds on the previous one, but we adapt based on what's giving your cohort trouble. If everyone's struggling with irregular income in week three, we spend extra time there instead of rushing ahead.

Live Sessions 90 min weekly

We meet once a week for guided practice. You'll share screens, work through problems together, and get feedback while you're actually doing the work. This isn't lecture format—you'll spend most of the time with your spreadsheet or app open.

Practice Tasks 20-30 min daily

Between sessions, you're tracking daily expenses and testing different scenarios. Some people do this over breakfast, others during lunch breaks. The key is making it part of your routine rather than homework you dread.

Quick Check-Ins as needed

Questions come up when you're staring at bills at 9pm on Thursday. Our group chat stays active and one of the instructors usually responds within a few hours. No waiting until next week when you're stuck.

Partner Sessions weeks 3 & 6

Money conversations with partners or housemates can get tense. We do two sessions specifically on talking about budgets with other people who share your expenses. These tend to be the most valuable sessions for couples.

Who Runs These Sessions

Our instructors have all dealt with budget crises in their own lives before getting into financial education. They know what it's like to rework everything after a job loss or unexpected expense.

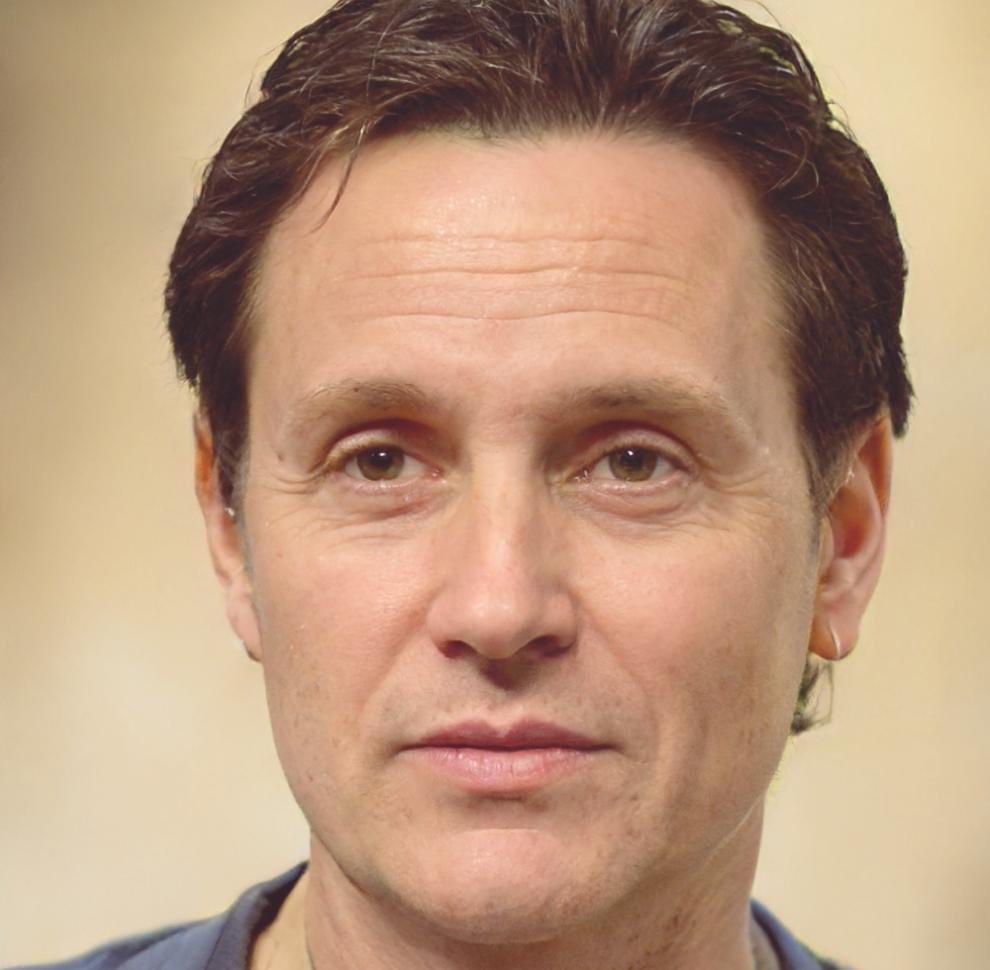

Bryson Kalkowski

Primary Instructor

Spent six years as a financial counselor before starting this program. He rebuilt his own budget three times through career changes and understands the frustration of advice that doesn't account for real life.

Indira Thornbrough

Specialist Instructor

Runs the partner communication sessions and irregular income modules. She managed freelance income for eight years while raising two kids and has practical strategies for unpredictable cash flow.

Quillan Vostok

Support Coordinator

Handles the between-session questions and reviews your practice work. He's the one who'll spot patterns in your spending that you might miss and suggest adjustments that actually work for your situation.